End of year review 2025

Uncorrelated Strategies Fund

This is a marketing communication for professional investors only. Capital at risk.

Past performance does not predict future returns.

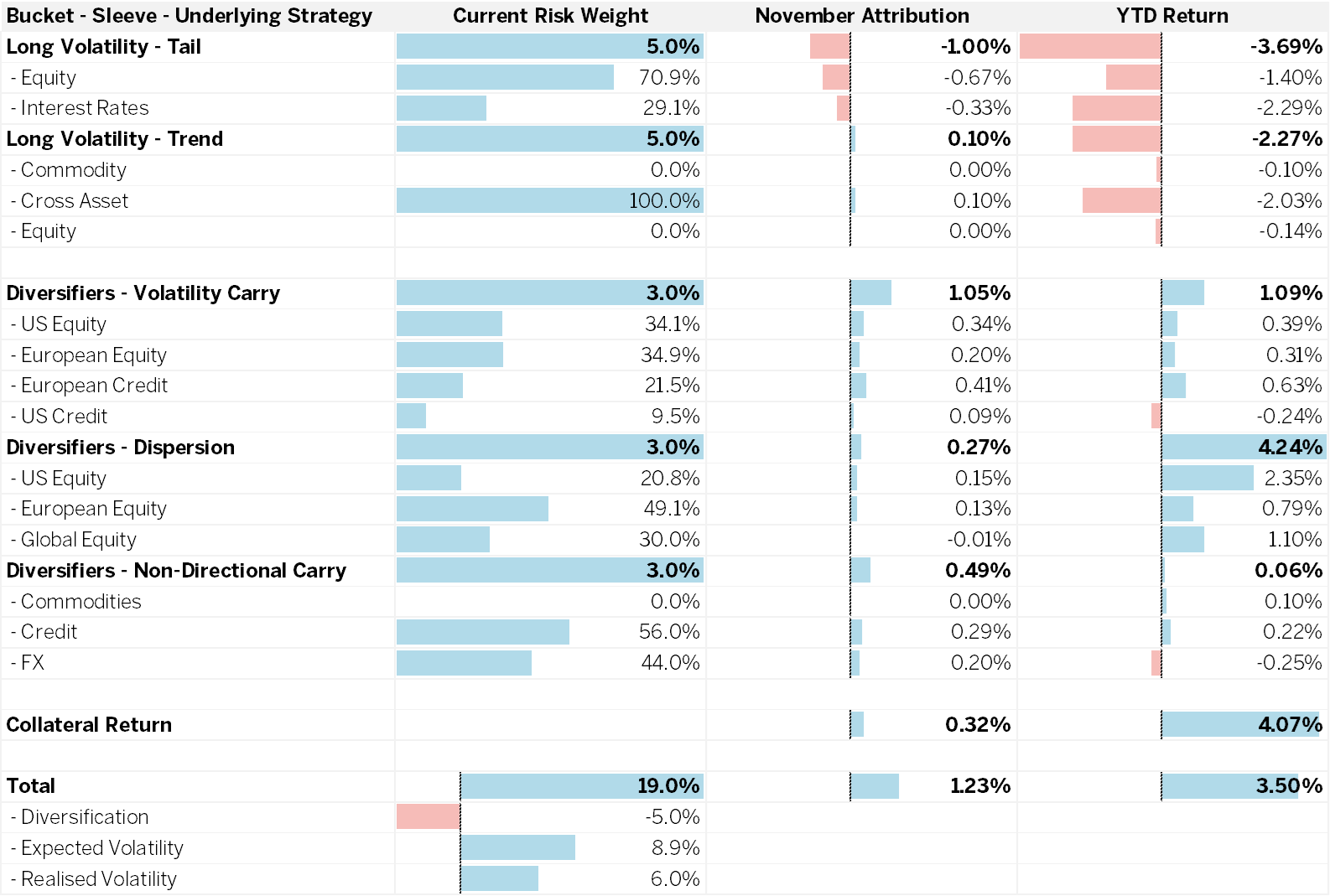

The Atlantic House Uncorrelated Strategies Fund posted a positive return for the year, returning 3.50% to the end of November. The year was a tale of two halves, with the liberation day volatility posing something of a ‘worst case’ scenario for the strategy – that being extremely short burst of volatility which recovers within a 2 day period - whilst the remainder of the year was characterised as a healthy playing ground for the strategy with risk premia remaining rich for the rest of the year. The strategy did particularly well from dispersion trading with the ‘AI’ boom creating very clear winners and losers.

Performance summary

-

Strong performance from Dispersion

-

Underperformance from Trend amidst high policy volatility

-

Rich risk premium remains and fund in strong position to capitalise

Source: Atlantic House as at 30/11/25.

Overview of the year

The fund entered the year with the return of Donald Trump to the White House. The market had responded to the re-election with optimism as the President promised to return to his previous agenda of tax cuts, and deregulation. However, the market did not anticipate the administrations agenda of using tariffs in as widespread a fashion as they were soon implemented. The tariffs which were implemented in early April served to rearrange the world order of trade and caused major issues for systematic strategies as correlations broke down, markets became illiquid even within the most liquid asset classes, such as US Treasuries, and global investors shunned US assets.

Within this episode of volatility there were two main sleeves of the fund which struggled. Volatility Carry suffered losses as equities saw the largest moves they have seen in COVID. This was not surprising to us, and whilst there was a loss in that sleeve, the trade implementation served to limit the downside by hedging on a more frequent basis and restriking positions as volatility rose. The second sleeve to suffer a loss was Trend which was served a double hit as the market fell after a period of strong performance, into a crash of correlation breakdowns across government bonds in Europe and the US – only to be reversed 3 days later as the tariffs were called off and countries began to come to the negotiating table.

The fund reached the point of max defensiveness the day before the tariffs were called off and would have stood to generate outsized returns if the market volatility had continued. However, the administration decided that the market volatility was too much in calling off the policy.

This volatility did, however, have a lasting impact in volatility markets. Implied volatility in equities and credit has remained elevated since the liberation day episode which has allowed the volatility risk premium to remain healthy. Something the strategy has captured, with the volatility carry sleeve regaining all the loss in April.

The other standout sleeve has been dispersion. The AI boom has created a clear divide between the ‘winners’ and ‘losers’ within the AI complex. This should perhaps be shown as ‘earning’ AI dollars, or ‘paying’ AI dollars. The spend on AI has been enormous with almost all of the growth in capex in the S&P going towards AI spend. This has led to a huge amount of dispersion between single stocks within the index which the strategy has been able to capture, posting strong returns for the year.

2026 outlook

Looking forward, the strategy is entering a year positioned for a cross-asset environment defined by rising divergence of companies, and potentially unstable macro trends. We have made improvements in the way we implement both volatility carry and trend to make them less susceptible to idiosyncratic policy volatility, whilst still allowing them to capture the rich risk premia which remains in the market. Dispersion is expected to widen as fundamentals decouple across sectors allowing for continued performance in that sleeve. Finally, pairing all the above with targeted long volatility positions to provide convex downside protection sets the fund in a strong position to navigate 2026.

We remain focused on:

-

Implementing each sleeve in the optimal way for the current market environment

-

Taking opportunistic positions in dispersion trades to continue the performance we’ve seen in 2025

-

Pairing our carry positions with strict risk management

-

Maintaining our scenario analysis to provide outsized returns in the bleakest of market scenarios

2023 Fund Reviews

This is a marketing communication. The fund is aimed at advised & discretionary market investors over the long term who have the capacity to tolerate a loss of the entire capital invested or the initial amount.

A final investment decision should not be contemplated until the risks are fully considered. A comprehensive list of risk factors is detailed in the Risk Factors Section of the Prospectus and the Supplement of the fund and in the relevant key investor information document (KIID). A copy of the English version of the Supplement, the Prospectus, and any other offering document and the KIID can be viewed at www.atlantichousegroup.com and www.geminicapital.ie. A summary of investor rights associated with an investment in the fund is available in English at ww.gemincapital.ie.

Please be aware that past performance is not indicative of future performance. The value of investments and income from them can go down as well as up, and you may get back less than originally invested.

Equity Risk: The fund has exposure to equity markets. The value of equities can rise and fall.

Counterparty Risk: The risk that a counterparty will not fulfil its payment obligation for a trade, contract or other transaction, on the due date.

Currency Risk: The fund holds assets denominated in other currencies, the value of which may rise and fall due to movements in exchange rates.

Interest Rate Risk: The fund’s investments are sensitive to changes in interest rates.

Operational Risk: The risk of direct or indirect loss resulting from inadequate or failed processes, people and systems including those relating to the safekeeping of assets or from external events.

Credit Risk: The risk the issuer of the bond fails to make interest or capital payments.

Liquidity Risk: The risk that the fund may be unable to sell an investment readily at its fair market value. In extreme market conditions this can affect the fund’s ability to meet redemption requests upon demand.

Derivatives Risk: The fund is permitted to use certain types of financial derivatives to achieve its objective. The value of these investments can rise and fall depending on the value of the underlying instrument. There is also a risk that the counterparty to these derivatives fails to meet its obligations.

For full information on these and other risks, please refer to the fund prospectus and offering documents, including the KID or KIID, as applicable.

This is a marketing communication issued by Atlantic House Investments Limited and does not constitute or form part of any offer or invitation to buy or sell shares. It should be read in conjunction with the Fund’s Prospectus, key investor information document (“KIID”) or offering memorandum. Atlantic House Investments Limited is authorised and regulated by the Financial Conduct Authority FRN 931264. Atlantic House Investments Limited is a Private Limited Company registered in England and Wales, registered number 11962808. Registered Office: One Eleven Edmund Street, Birmingham. B3 2HJ.

The contents of this article are based upon sources of information believed to be reliable. Atlantic House Investments Limited has taken reasonable care to ensure the information stated is accurate. However, Atlantic House Investments Limited make no representation, guarantee or warranty that it is wholly accurate and complete.

This material may not be disclosed or referred to any third party or distributed, reproduced or used for any other purposes without the prior written consent of Atlantic House, any data provider and any other third party whose data is included herein and must be returned on request to Atlantic House and any copies thereof in whatever form destroyed.

A decision may be taken at any time to terminate the arrangements for the marketing of the Fund in any jurisdiction in which it is currently being marketed. Shareholders in affected EEA Member State will be notified of any decision to terminate marketing arrangements in advance and will be provided the opportunity to redeem their shareholding in the Company free of any charges or deductions for at least 30 working days from the date of such notification.

GemCap Investment Funds (Ireland) plc is authorised in Ireland by the Central Bank of Ireland pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 (S.I. No. 352 of 2011) (the “UCITS Regulations”), as amended.

Gemini Capital Management (Ireland) Limited, trading as GemCap, is a limited liability company registered under the registered number 579677 under Irish law pursuant to the Companies Act 2014 which is regulated by the Central Bank of Ireland. Its principal office is at Suites 22-26 Morrison Chambers, 32 Nassau Street, Dublin 2, D02 X598 and its registered office is at 7th Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02E762. GemCap acts as both management company and global distributor to GemCap Investment Funds (Ireland) plc.

Capital is at risk. Past performance does not predict future returns.