Atlantic House

Defensive Defined Returns Fund

The fund aims to deliver positive returns over the medium-to-long term even in all but the most adverse market conditions.

Jack Roberts

CFA | Fund Manager

8 years of experience

8 years in group

Mark Greenwood

Deputy CIO, Head of Investment Risk

26 years of experience

4 years in group

Tom May

CIO

25 years of experience

17 years in group

The Defensive Defined Returns fund was previously named the Balanced Return Fund. The fund changed name on 18 December 2025.

Why consider this fund?

5-7% annualised long-term return

Positive long-term growth, except in periods of significant and sustained equity market falls.

Targeting predictable returns

Built to target positive returns across a wider range of market conditions than UK large-cap equities.

Systematic protection overlay

Employs a protection overlay designed to reduce equity sensitivity and help guard the portfolio during stressed market conditions.

Consistent income

Offers an income share class providing regular distributions, paid from the fund’s capital.

Jack Roberts, Lead Fund Manager and Delia Villiers, Head of UK Discretionary Sales, explain why we have made the recent changes to the Defensive Defined Returns Fund, what it aims to do, and what investors should expect?

What does the fund invest in?

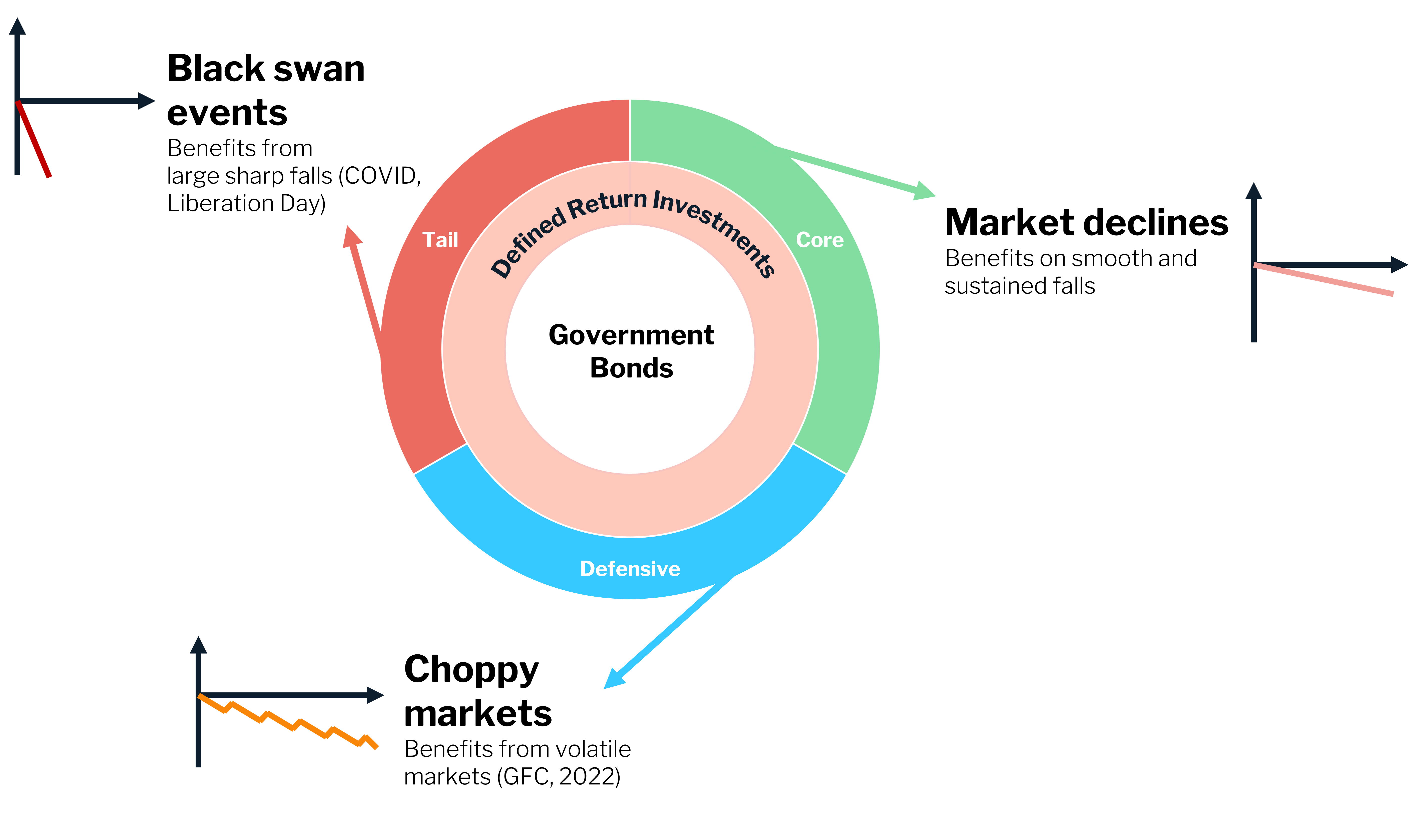

The fund combines laddered defined return investments with a systematic protection overlay to help reduce equity sensitivity and drawdowns during stress periods.

Laddered Defined Return Investment

The fund owns a collection of investments that access a similar payoff profile to autocalls, which offer equity-like returns whilst giving investors downside protection up to pre-specified levels.

The fund primarily invests in Government Bonds, which provide the underlying capital return over time. The return on capital is generated from options on large global indices. The combination of the two creates 'Defined Return Investments', also known as autocalls.

Protection Overlay

The protection overlay blends three complementary styles (Core, Defensive and Tail) to create a balanced defensive portfolio. In a broad market sell-off where volatility rises, this systematic positioning is designed to deliver positive performance and help cushion portfolio drawdowns inherent from the Defined Return Investments.

Performance as at 28th November 2025

Past performance does not predict future returns.

Cumulative performance (%)

Source: Atlantic House. FE Analytics. NAV performance. Total Return basis in GBP as at 28/11/25.

Calendar Year Performance (%)

Source: Atlantic House. FE Analytics. NAV performance. Total Return basis in GBP as at 28/11/25.

The fund is officially grouped into the IA Targeted Absolute Return Sector. However, given the fund has a 60% exposure to equity through defined return investments, we see the appropriate benchmark (internally) as the IA Mixed Investment 20% - 60% sector. However, IA rules dictate that to officially be in this sector, a fund must hold between 20% and 60% in direct equity. Since the fund’s exposures to equity are not through direct investments, but instead are through derivatives, the fund is officially grouped into the IA Targeted Absolute Return Sector instead.

Fund insights and webinars

This is not a comprehensive list of every risk factor. You can view the full list in the Risk Warning section of the Prospectus, Supplement and Key Investor Information Document here.

-

The Fund’s returns will not keep pace with strong rises in equity markets.

-

The value of investments and any income from them can go down in value, and you could get back less than invested.

-

There is no guarantee that the Fund will achieve its objective.

-

The Fund invests in derivatives. Derivatives are highly sensitive to changes in the value of the asset from which their value is derived. A small movement in the value of the underlying asset can cause a large movement in the value of the derivative. This can increase the sizes of losses and gains, causing the value of a derivative investment to fluctuate and the Fund could lose more than the amount invested.

-

The Fund invests in high quality government and corporate bonds. All bonds will be rated at least A- by Standard and Poors at outset. If any of the bonds the Fund owns suffer credit events the performance of the Fund could be adversely affected.

-

The Fund may invest in securities and markets which experience specific risks due to increased volatility, liquidity, political and economic stability.

-

Other risks the Fund is exposed to include but are not limited to, credit, custodial and counterparty risk, possible changes in exchange rates, interest rates and inflation, changing expectations of future market volatility, changing expectations of equity market correlation and changing dividend expectations.

-

Objective: To generate positive returns in most market conditions over any given three-year period.

Launch date: 5 December 2018

Fund size: £42.54m

Comparator Benchmark: Solactive United Kingdom Large Cap Ex-Investment Trust Net Total Return Index

Minimum investment: £1,000

Dealing: Daily

Ongoing Charges (OCF): 0.75% (Capped)

Manager: Gemini Capital Management (Ireland) Limited

Domicile: Dublin, Ireland

Fund Identifiers: A share class: SEDOL: BDZQTC8, ISIN: IE00BDZQTC81, BLOOMBERG: AHFMTAA ID

7IM, abrdn, Aegon ARC, AJ Bell, Aviva, Elevate, Fidelity, Fundment, M&G (Ascentric), Nucleus, Pershing, Quilter, Raymond James, Transact, and Wealthtime (Novia)

-

This is a marketing communication.

-

A copy of the English version of the Supplement, the Prospectus, and any other offering document and the KIID can also be viewed at www.geminicapital.ie. A summary of investor rights associated with an investment in the Fund is available in English at www.geminicapital.ie.

-

A decision may be taken at any time to terminate the arrangements for the marketing of the Fund in any jurisdiction in which it is currently being marketed. Shareholders in affected EEA Member State will be notified of any decision marketing arrangements in advance and will be provided the opportunity to redeem their shareholding in the Company free of any charges or deductions for at least 30 working days from the date of such notification.

-

Capital is at risk. Past performance does not predict future returns.