End of year review 2025

Atlantic House Solutions

This is a marketing communication for professional investors only. Capital at risk.

Past performance does not predict future returns.

It was another bumper year for Structured Security issuance with the backdrop of stellar equity returns, falling interest-rates, tight credit spreads and muted equity volatility aside from the short, sharp spike in April following the Trump Tariffs announcements. Constructive equity markets saw a record number of Autocall maturities and clients continued to invest in a suite of defined return investments in a favourable pricing environment, often with a defensive bias given rich equity valuations. In addition, we saw an uptick in volumes across Equity replacement trades, Hedging, Income and Rates-linked structures with asymmetric payoffs. Investors continue to embrace defined returns to help build better portfolios.

Performance Summary

-

Almost £2.5bn notional originated and executed in 2025

-

Autocallables remain the most popular payoff

-

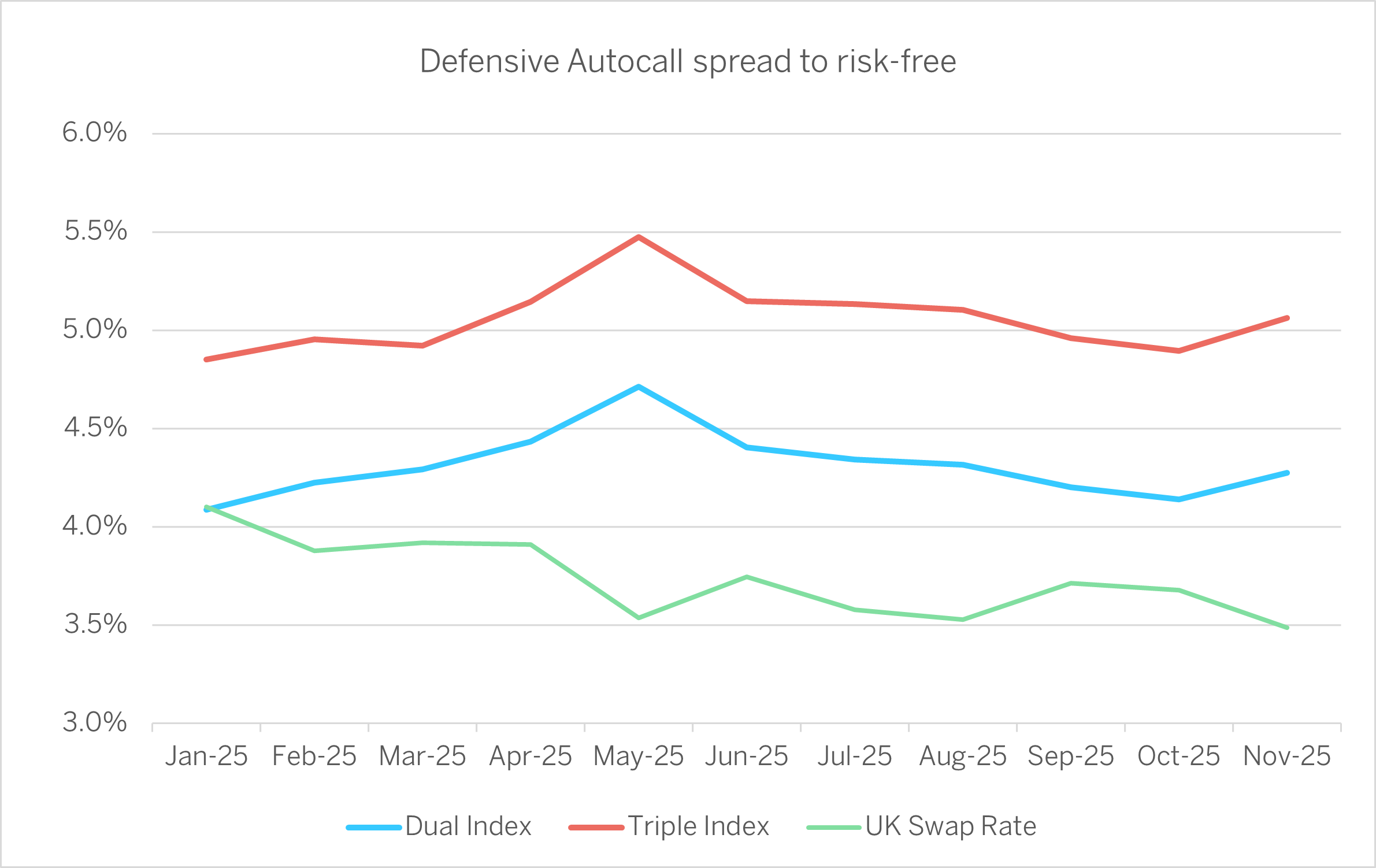

Rates on a downward trend

Past performance is no guide to the future.

Source Atlantic House, Bloomberg 3/1/25 - 3/11/25

Overview of the year

After strong back-to-back equity index performance for developed markets in 2023 and 2024, investors were cautious at the start of 2025 and the tariff induced volatility leading up to and immediately after the 2nd April announcements by President Trump did little to allay fears. However, the swift reversal of some of the initial announcements saw implied volatility fall back to almost where it started the year by the end of April. Markets then rallied strongly with some pullback in the latter part of 2025. A weaker dollar, the longest government shutdown on record, a narrow and concentrated equity market, AI concerns and policy uncertainty did little to offset robust earnings and both prospective and realised rate-cuts.

Investors have continued to use structured products as a key tool for defined returns within diversified portfolios. The most popular trades continue to be Autocallables within the UK, with a bias for falling barriers which increase the probability of positive returns in a downward trending market. As interest-rates have fallen over the year, there was an increase in Income and longer-dated maturities to lock-in attractive yields. Japanese indices grew in popularity further this year as the Nikkei rallied over 50% from its April low on shareholder-friendly reforms and a pro-business government. Despite rising rates in Japan, they remain low by developed market standards and the low forward and relatively high volatility of the equity indices offer a compelling pricing uplift with investors choosing lower barriers whilst still achieving enhanced coupons.

Rates in the UK have fallen by around 75bps this year (2y GBP swaps) despite just one 25bps cut in the Base Rate by the Bank of England. Curves have steepened however lessening the impact of the traditional diversifier of longer duration. Rates volatility, unlike equity vol, was elevated for much of the year and we have seen an increase in Issuer Callable notes which are implicitly short a rates option. Additionally, many of these notes have been structured with full capital protection further playing into the theme for more defensive payoffs and other alternatives to traditional diversifiers, such as Dispersion.

Gold has rallied significantly this year on the back of a weaker USD, lower US real rates and strong institutional/central bank demand. High forwards, no natural yield and high implied volatility mean some common payoffs such as autocalls don’t price very well. However, combining an Issuer call feature and full capital protection have enabled us to price and trade some very compelling structures, offering mid double-digit coupons or participation in the asset with full downside protection at maturity.

2026 Outlook

Equity valuations in parts of developed markets (especially U.S.) are elevated. If macro surprises (inflation resurgence, growth slowdown, policy mis-step) occur, we may see a continued pick-up in volatility and more divergent markets. After 3 consecutive years of stellar equity returns, investors are likely to continue to look for investments with asymmetric risk profiles and diversifiers that can help to build better portfolios.

We remain focused on:

-

Origination and execution to help investors build better portfolios

-

Multi-asset structured product pricing and ideas

-

Education and support for Investment Managers

-

Strategic and tactical implementation of Alternatives

2023 Fund Reviews

This is a marketing communication. The fund is aimed at advised & discretionary market investors over the long term who have the capacity to tolerate a loss of the entire capital invested or the initial amount.

A final investment decision should not be contemplated until the risks are fully considered. A comprehensive list of risk factors is detailed in the Risk Factors Section of the Prospectus and the Supplement of the fund and in the relevant key investor information document (KIID). A copy of the English version of the Supplement, the Prospectus, and any other offering document and the KIID can be viewed at www.atlantichousegroup.com and www.geminicapital.ie. A summary of investor rights associated with an investment in the fund is available in English at ww.gemincapital.ie.

Please be aware that past performance is not indicative of future performance. The value of investments and income from them can go down as well as up, and you may get back less than originally invested.

Equity Risk: The fund has exposure to equity markets. The value of equities can rise and fall.

Counterparty Risk: The risk that a counterparty will not fulfil its payment obligation for a trade, contract or other transaction, on the due date.

Currency Risk: The fund holds assets denominated in other currencies, the value of which may rise and fall due to movements in exchange rates.

Interest Rate Risk: The fund’s investments are sensitive to changes in interest rates.

Operational Risk: The risk of direct or indirect loss resulting from inadequate or failed processes, people and systems including those relating to the safekeeping of assets or from external events.

Credit Risk: The risk the issuer of the bond fails to make interest or capital payments.

Liquidity Risk: The risk that the fund may be unable to sell an investment readily at its fair market value. In extreme market conditions this can affect the fund’s ability to meet redemption requests upon demand.

Derivatives Risk: The fund is permitted to use certain types of financial derivatives to achieve its objective. The value of these investments can rise and fall depending on the value of the underlying instrument. There is also a risk that the counterparty to these derivatives fails to meet its obligations.

For full information on these and other risks, please refer to the fund prospectus and offering documents, including the KID or KIID, as applicable.

This is a marketing communication issued by Atlantic House Investments Limited and does not constitute or form part of any offer or invitation to buy or sell shares. It should be read in conjunction with the Fund’s Prospectus, key investor information document (“KIID”) or offering memorandum. Atlantic House Investments Limited is authorised and regulated by the Financial Conduct Authority FRN 931264. Atlantic House Investments Limited is a Private Limited Company registered in England and Wales, registered number 11962808. Registered Office: One Eleven Edmund Street, Birmingham. B3 2HJ.

The contents of this article are based upon sources of information believed to be reliable. Atlantic House Investments Limited has taken reasonable care to ensure the information stated is accurate. However, Atlantic House Investments Limited make no representation, guarantee or warranty that it is wholly accurate and complete.

This material may not be disclosed or referred to any third party or distributed, reproduced or used for any other purposes without the prior written consent of Atlantic House, any data provider and any other third party whose data is included herein and must be returned on request to Atlantic House and any copies thereof in whatever form destroyed.

A decision may be taken at any time to terminate the arrangements for the marketing of the Fund in any jurisdiction in which it is currently being marketed. Shareholders in affected EEA Member State will be notified of any decision to terminate marketing arrangements in advance and will be provided the opportunity to redeem their shareholding in the Company free of any charges or deductions for at least 30 working days from the date of such notification.

GemCap Investment Funds (Ireland) plc is authorised in Ireland by the Central Bank of Ireland pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 (S.I. No. 352 of 2011) (the “UCITS Regulations”), as amended.

Gemini Capital Management (Ireland) Limited, trading as GemCap, is a limited liability company registered under the registered number 579677 under Irish law pursuant to the Companies Act 2014 which is regulated by the Central Bank of Ireland. Its principal office is at Suites 22-26 Morrison Chambers, 32 Nassau Street, Dublin 2, D02 X598 and its registered office is at 7th Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02E762. GemCap acts as both management company and global distributor to GemCap Investment Funds (Ireland) plc.

Capital is at risk. Past performance does not predict future returns.